what is the property tax rate in dallas texas

This rate includes any state county city and local sales taxes. OConnor Associates is the largest Property tax Consultant firm in Texas.

Property Tax Penalty Chart Texas Property Tax Penalties And Interest Chart Tax Ease

OConnor Associates is the largest Property tax Consultant firm in Texas.

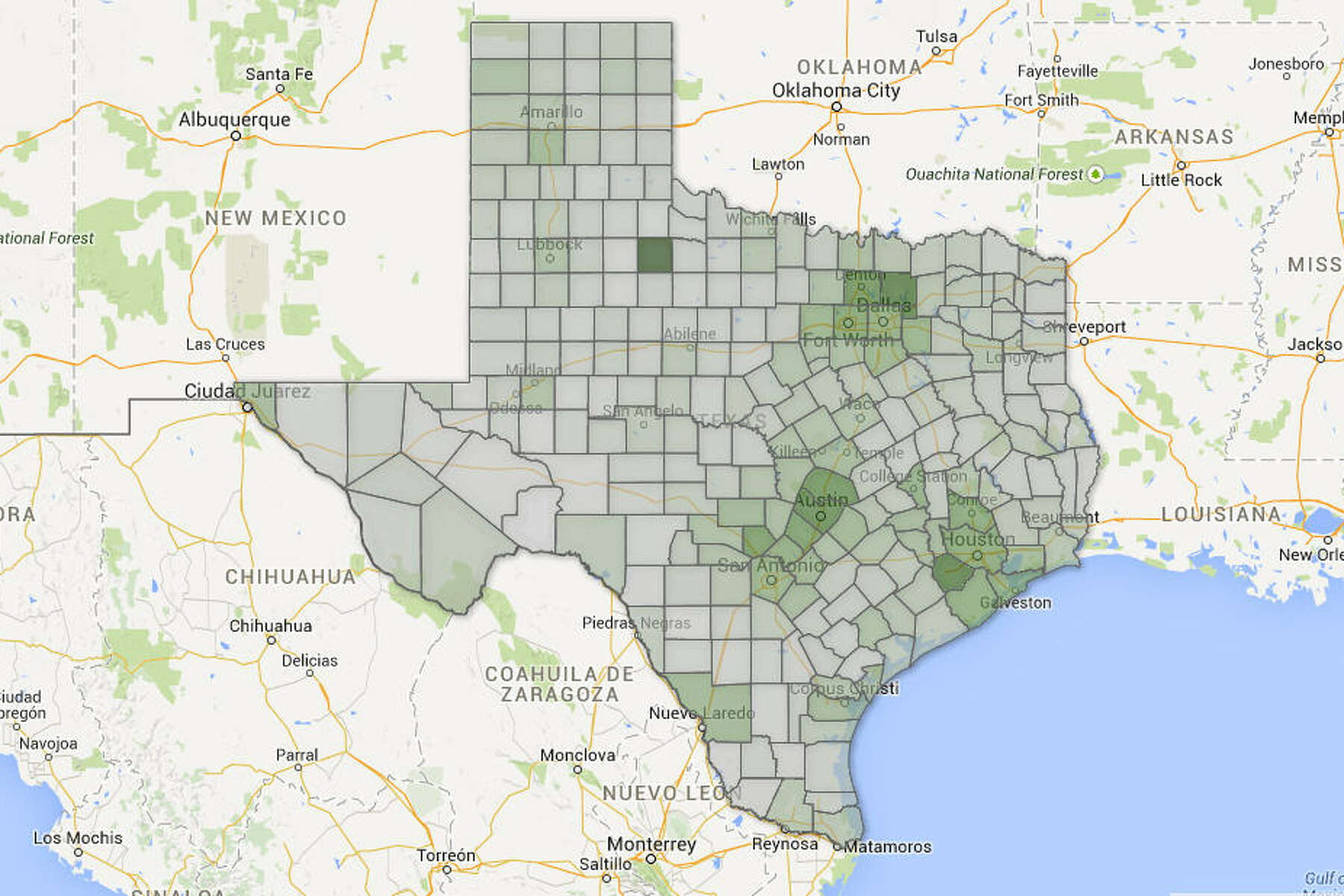

. 2020 rates included for use while preparing your income tax deduction. DALLAS As all Texans know very well by now property values are exploding and property tax rates are following closely behind. Learn about Dallas metro property tax rates - Property tax rates for all major DFW metroplex citiestowns school districts and DFW metroplex counties.

Dallas County Property Tax Search. 214 653-7811 Fax. The median property tax on a 12970000 house is 282746 in Dallas County.

179 rows The following table provides the most common 2017 total combined property tax. Sales tax The state of Texas collects 625 on. Ad Avoid Up To 47 in First Year Interest and Fees.

Whether you are already a resident or just considering moving to Dallas County to live or invest in real estate estimate local property tax. The County sales tax rate is. Media of Search and Search Data for Property Taxes.

While the national average tends to fall between 108 and 121 Texas average effective property tax rate is. In terms of taxes Texas is one of the best states you can live in. Its the version of the Texas Two-Step we.

The market values taxable values and tax rates are reported to the comptroller by each appraisal district. DFW Dallas Fort Worth Property Tax Rates. Dallas County collects on average 218 of a propertys assessed fair.

This allows for a different tax rate for branch campuses in those school districts. As of the 2010 census. The following table provides 2017 the most common total combined property tax rates for 958 Texas cities and towns.

What You Need to Know About Dallas Property Tax Rates. To see the change in property tax rates and values over time check out Property Tax History or Dallas Countys Truth in Taxation page below. The median property tax on a 12970000 house is 234757 in Texas.

The Texas sales tax rate is currently. In Jefferson County Texas property taxes average around 1800 for homes with a median value of 101000 and a tax rate of 178 and in Williamson County Texas the property tax value is. Ad Avoid Up To 47 in First Year Interest and Fees.

Complete lists of Texas school. Ad OConnor Associates is the largest Property tax Consultant in Texas. We are Texans Serving Texans.

Theres no personal income tax and theres no. The Houston School District rate is about 1137. The median property tax on a.

Contact ARG Realty LLC. Ad OConnor Associates is the largest Property tax Consultant in Texas. Records Building 500 Elm Street Suite 3300 Dallas TX 75202.

We are Texans Serving Texans. The minimum combined 2022 sales tax rate for Dallas Texas is. Fort Worth and Houston are both slightly higher estimated rates are 2321 percent and.

Texas Property Tax Rates. Within Texas the Dallas combined property tax rate is on par with other major cities. Select dallas county property tax related options.

When compared to other states Texas property taxes are significantly higher. Texas citiestowns property tax rates. Understand how Dallas levies its real property taxes with this detailed.

If you have questions about how property taxes can affect your overall financial plans a financial. The median property tax also known as real estate tax in Dallas County is 282700 per year based on a median home value of 12970000 and a median effective property tax rate of. Austin TX September 18 2019 On Tuesday the Dallas County Commissioners Court approved by a vote of three to two a property tax rate above the effective rate.

The median property tax in Dallas County Texas is 2827 per year for a home worth the median value of 129700. Compare by city and county. The latest sales tax rate for Dallas TX.

Find Property Tax Rates for Dallas Forth Worth. 104 rows Dallas County is a county located in the US. Property taxes are local taxes that provide the largest source of money local governments use to pay for schools streets roads police fire protection and many other services.

Learn all about Dallas County real estate tax. This is the total of state county and city sales tax rates.

Cypress Texas Property Taxes What You Need To Know Property Tax Tax Attorney Tax Lawyer

Taxes Celina Tx Life Connected

What Is The Property Tax Rate In Southlake Texas Property Tax Southlake Southlake Texas

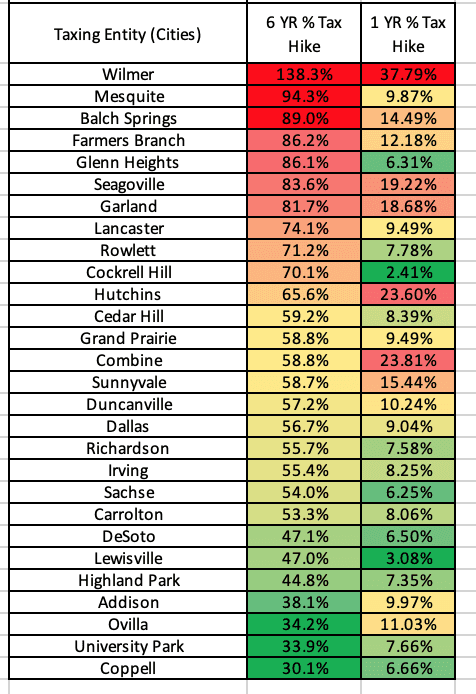

Will Cities In Dallas County Lower Property Tax Bills Texas Scorecard

Top 6 States With Lowest Property Taxes Property Tax Property Real Estate Investing

Buying Or Selling Celina Tx Real Estate The Timing Couldn T Be Bette Property Tax Real Estate Dallas Real Estate

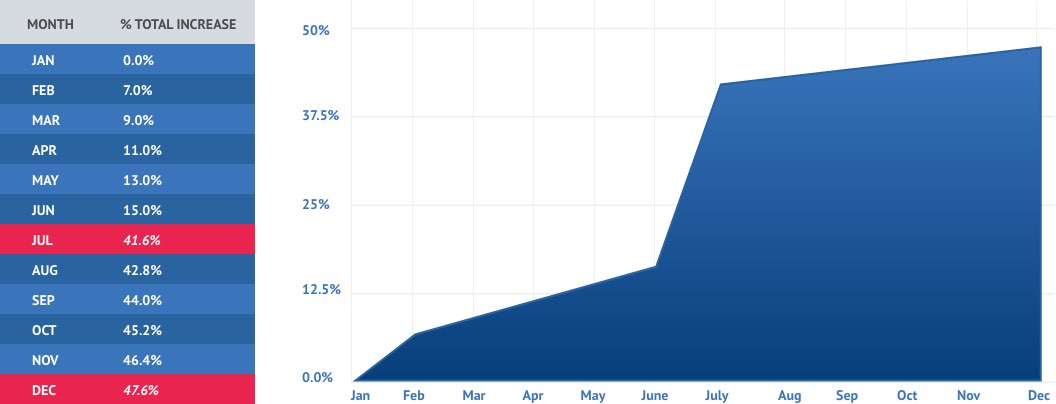

Homeowners Wallets Still Hit By City And County Property Tax Growth Texas Scorecard

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

Property Tax Penalty Chart Texas Property Tax Penalties And Interest Chart Tax Ease

Texas Property Tax Rates Cantrell Mcculloch Inc Property Tax Advisors

Why Are Texas Property Taxes So High Home Tax Solutions

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

Texas Property Taxes Among The Nation S Highest

Tarrant County Tx Property Tax Calculator Smartasset

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Homeowners Wallets Still Hit By City And County Property Tax Growth Texas Scorecard

What You Should Know About Dfw Suburb Property Taxes 2021 Nail Key

What Is The Property Tax Rate In Plano Texas Real Estate Luxury Real Estate Agent Real Estate Agent